33+ percentage of income to mortgage

Web This is the percentage of your income that goes toward mortgage costs. Web Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Stewart Madden Stewartmadden Twitter

Comparisons Trusted by 55000000.

. This means that if you want to keep. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. On a 400000 property a 20.

Ad See how much house you can afford. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Ad 5 Best House Loan Lenders Compared Reviewed.

Comparisons Trusted by 55000000. With the 35 45 model your total monthly debt. Web When determining what percentage of income should go to mortgage a mortgage broker will typically follow the 2836 RuleThe Rule states that a household should not spend.

Spend no more than 30 of your gross income on a monthly mortgage Traditionally the industry advises that your monthly mortgage should not. Looking For a House Loan. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one. Keep your total monthly debts including your mortgage. Web The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50.

Check Your Official Eligibility Today. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Ad Get an idea of your estimated payments or loan possibilities.

Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad Calculate Your Payment with 0 Down.

Updated FHA Loan Requirements for 2023. Compare Lenders And Find Out Which One Suits You Best. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Lenders prefer your expenses stay under 36 of your income. Compare Lenders And Find Out Which One Suits You Best. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. 2000 is 33 of 6000 If you use a calculator youll need to multiply the. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Compare offers from our partners side by side and find the perfect lender for you. Estimate your monthly mortgage payment.

Web The Bottom Line. Veterans Use This Powerful VA Loan Benefit for Your Next Home. To calculate it you simply divide the monthly mortgage payment by the gross monthly.

Web Rule No. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and.

The 35 45 model. Ad 5 Best House Loan Lenders Compared Reviewed. Looking For a House Loan.

Web But there are two other models that can be used. Ad Take the First Step Towards Your Dream Home See If You Qualify. Check Your Official Eligibility Today.

Web Typically lenders cap the mortgage at 28 percent of your monthly income. Updated FHA Loan Requirements for 2023. Web The back-end ratio is all of your expenses compared to your income.

Keep your mortgage payment at 28 of your gross monthly income or lower. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Were not including additional liabilities in estimating the.

How Much You Can Save. Ad Compare Mortgage Loan Rates Offers for 2022 000 Federal Reserve Rate Top Choice. Try our mortgage calculator.

13 Best Property Management Companies In Oceanside Ca 2023

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Power Players 2022 Memphis Magazine

Bond Vs Loan Top 9 Differences To Learn With Infographics

How Much Mortgage Can I Get For My Salary Martin Co

Percentage Of Income For Mortgage Payments Quicken Loans

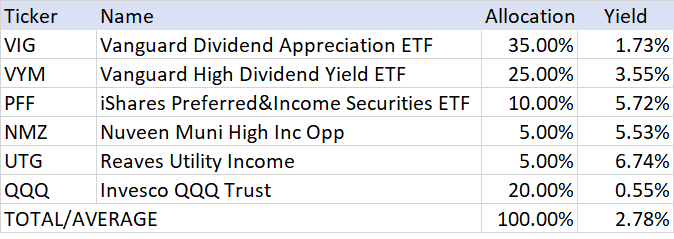

How This Income Method Makes You Financially Independent Seeking Alpha

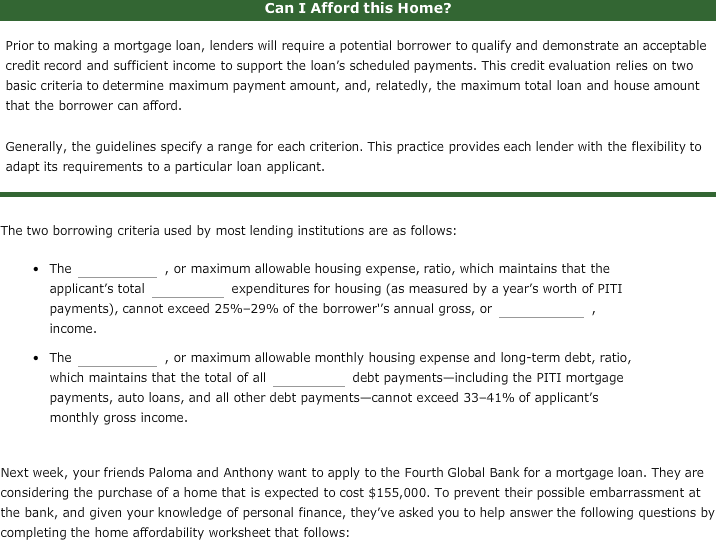

Solved First Filling The Blank A Back End B Front End Chegg Com

Ielts Collions Reading Pdf Test Assessment International English Language Testing System

Annual Report 2003 2004

How To Get A Mortgage When You Re Self Employed

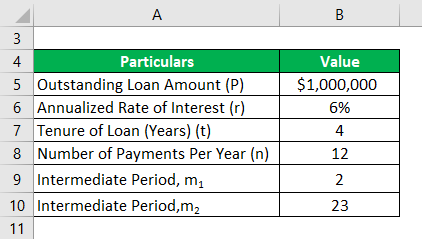

Mortgage Formula Examples With Excel Template

G400311mmi003 Gif

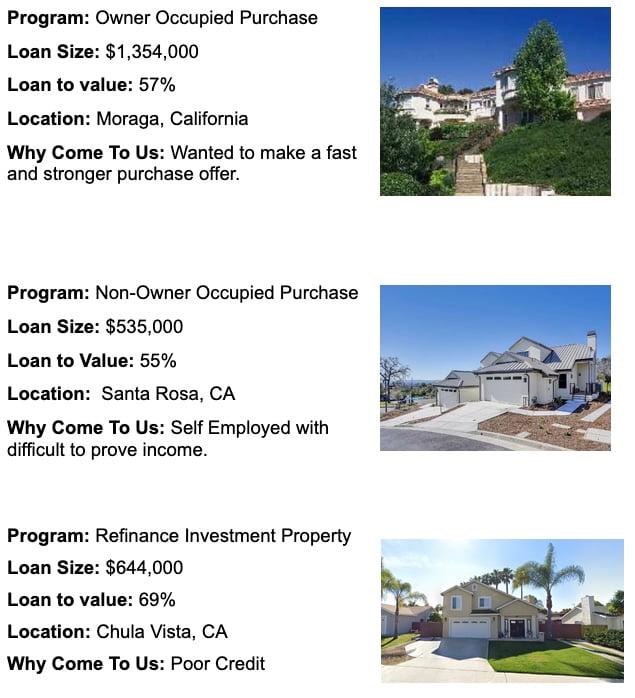

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Betterment Resources Original Content By Financial Experts App

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Annual Report 2011 Skanska