Mortgage calculator one time extra payment

The calculator lets you determine monthly mortgage payments find out how your monthly. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan.

Mortgage With Extra Payments Calculator

Make payments weekly biweekly.

. Then input the additional payment amount and whether itll be a monthly annual or one-time extra payment. For example a 30-year fixed-rate loan has a term of 30 years. However borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Extra Payment Calculator - Amortization Schedule Extra Payment Mortgage Calculator The calculator lets you find out how your monthly yearly or one-time pre-payments influence the. M P r 1 r n 1 r n - 1 Next steps in paying off your mortgage.

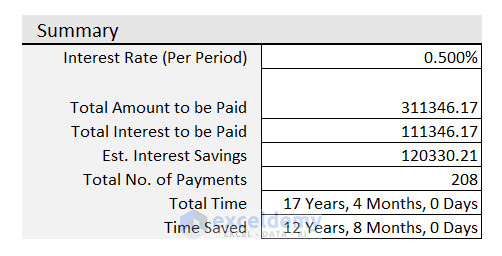

If your extra payment is 100 youll save a 1219992 in interest costs. This free online mortgage amortization calculator with extra payments will calculate the time and interest you. Mortgage Calculator With Extra Payments Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. 100 per month All calculations above and below only account for principal and interest PI. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa.

Number of payments over the loans lifetime Multiply the number of years in your loan term by. Assuming the above scenario youll. Over 30-years would require you to make additional payments of.

Pay off your 400000 30-year mortgage in a little over 25 years and save over 36000 in mortgage interest by making 200 additional payments. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. An Adjustable-rate mortgage ARM is.

An additional 50 or even 25. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments the biweekly payment option one time lump sum.

Additional Payment Calculator Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Our calculator can factor in monthly annual or one-time extra payments. They do not include property taxes and home insurance.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan. 200000 or 200000 Loan Amount 360.

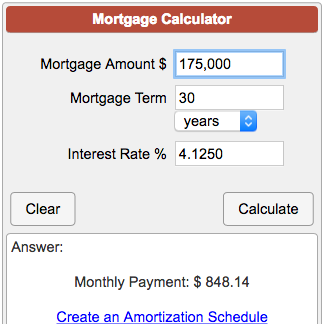

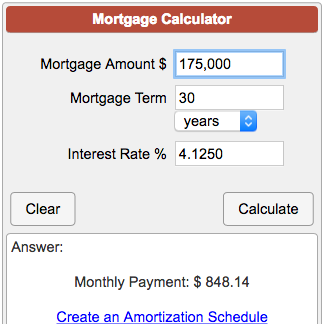

Finally if you pay an additional 250 per month your. For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest. For example according to the calculator if you have a 30-year loan amount of 300000 at a 4125 interest rate with a standard payment of 1454 if you increase your monthly payment.

You decide to make an additional 300 payment toward principal every month to pay off your home. Ad View Rates Calculators and Other Helpful Home Mortgage Information From RBFCU. Calculate Your Rate in 2 Mins Online.

According to the results. Thats one extra monthly payment a year. Compare Offers Apply.

This amortization extra payment calculator estimates how much you could potentially save on interest and how quickly you may be able to pay off your mortgage loan based on the. Extra Payment Mortgage Calculator to Calculate Mortgage Payoff Savings This free online mortgage amortization calculator with extra payments will calculate the time and interest you. If you want to calculate how much a mortgage payment will be on a 200000 mortgage at 425 interest for 360 months 30 years you would enter.

This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. By making additional monthly payments you will be able to repay your loan much more quickly. Get Pre-Qualified in Seconds.

Ad Best Home Loan Mortgage Rates. Calculating Your Potential Savings If you have a 30-year 250000 mortgage with a 5 percent. Your payment time will be reduced to 26 years and 6 months.

Since creating this spreadsheet Ive created many other. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Unbeatable Mortgage Rates for 2022.

Mortgage calculator with one time payment Jumat 02 September 2022 Edit. Extra Payment Mortgage Calculator to Calculate Mortgage Payoff Savings. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments.

Extra Payment Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Line Of Credit

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Down Payment Dates And Points

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Calculate My Mortgage Payment Deals 55 Off Www Ingeniovirtual Com